build back better bill summary

Momentum is building among congressional democrats to approve the build back better act a massive bill that includes significant tax increases impacting large corporations and high-income individuals to pay for lower- and middle-class tax relief and fund new spending for white house priorities such as expanded access to prekindergarten. The majority of the redesign would start to be effective January 1 2024 not for the upcoming 2023 bid cycle.

The Build Back Better Framework The White House

The bill creates new tax credits for 1 qualifying zero-emission nuclear power produced and sold after 2023 2 the sale or mixture of sustainable aviation fuel beginning in 2023 3 the production of clean hydrogen 4 the production of clean electricity and for investment in zero-emissions electricity generation facilities or energy storage.

. A Summary for the HCH Community The US. Among its Medicaid and the Childrens Health Insurance. November 2021 Key Provisions in the Build Back BetterAct.

The Build Back Better Act provides 10 billion for pandemic preparedness including providing 70 billion in funding to support core public health infrastructure activities to strengthen the public health system through grants to state territorial local or Tribal health departments and expanding and improving activities of the Centers for. Principal Washington National Tax KPMG US. However in 2022 only taxpayers with incomes below 150000 for joint filers 112500 for heads of household and 75000 for all other files will receive advance payments.

The Financial Accountability and Corporate Transparency FACT Coalition urges Congress to advance needed international tax reforms as part of the 2021 budget reconciliation process by passing the Build Back Better Act HR. Senate Democrats on President Bidens ambitious Build Back Better Act BBBA which passed the House of Representatives on November 19th. President Bidens Build Back Better Plan would invest in training initiatives to help the millions of American workers to create high-quality employment in expanding fields through high-quality career and technical education paths and registered apprenticeships.

The Build Back Better Act includes numerous provisions that would dramatically strengthen and expand both public and private health insurance coverage. It would restrict how much drugmakers can increase their prices each year and set an annual. The BBBA contains a majority of President Bidens social spending agenda.

Here are some of the highlights. The draft bill also proposes a redesign of the Part D benefit. House of Representatives passed the Build Back Better Act HR.

Current Summary Build Back Better Act 1 Current Summary Build Back Better Act Key Nonprofit and Civic Infrastructure Provisions As Released November 3 2021 - Rules Committee Print 117-18 Key Provisions Impacting Individuals - Page 2 Tax Provisions Impacting Nonprofit Organizations - Page 3 Small Business and Nonprofit Employers - Page 4. Build Back Better Act Rules Committee Print Section-By-Section. The 175 trillion legislation includes major investments in health care housing education jobs climate and other social programs.

This section defines the term insular area to have the same meaning as in section 1404 of the. Build Back Better International Tax Reform Summary. Its a scaled-down version of the Build Back Better bill a multi-trillion-dollar climate and social safety net package that Democrats failed to.

Home Insights Summary of Provisions in. The VAs buildings are on average 60 years old and 69 of the Departments main hospitals are at least 50 years old. This results in a credit of 3000 3600 for children under age 6 and for most taxpayers the credit is advanceable.

House of Representatives passed a 185 trillion Build Back Better 10-year budget reconciliation package by a near party-line vote of 220-213. The Build Back Better bill also delivers a compromise for taking on Big Pharma over rising drug prices. 5376 summary on November 19 2021.

This bill invests heavily in clean renewable energy that will reduce our dependence on fossil fuels and accelerates our transition to a green energy future. Over 350 billion in climate action clean energy jobs and environmental justice. TITLE I COMMITTEE ON AGRICULTURE.

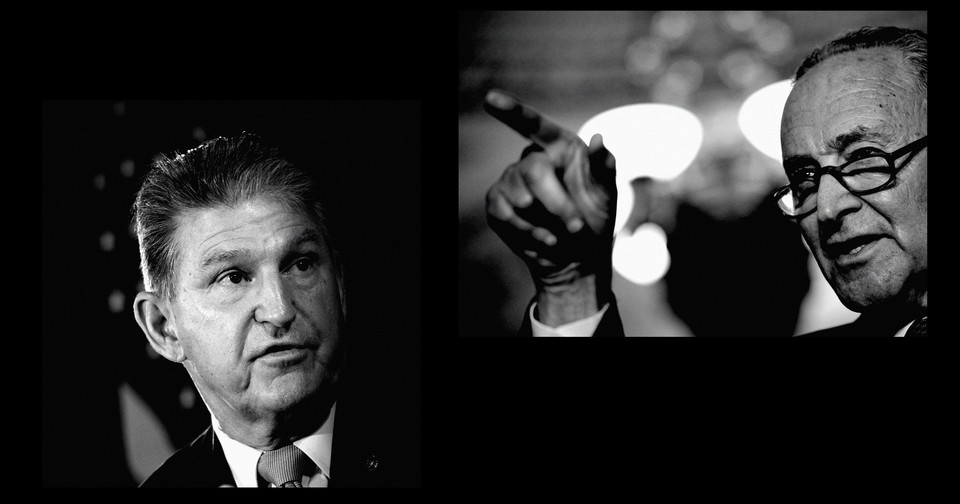

House of Representatives has released new text of proposed tax legislation as part of this Build Back Better Act BBBA legislative effort. This bill is a somewhat slimmed down version of the Build Back Better economic plan proposed by the Biden Administration in April. In the midst of negotiations and parliamentary procedures Senator Joe Manchin publicly pulled his support from the bill for not matching his envisioned cost of about 175 trillion then subsequently retracted support for his own compromise legislation.

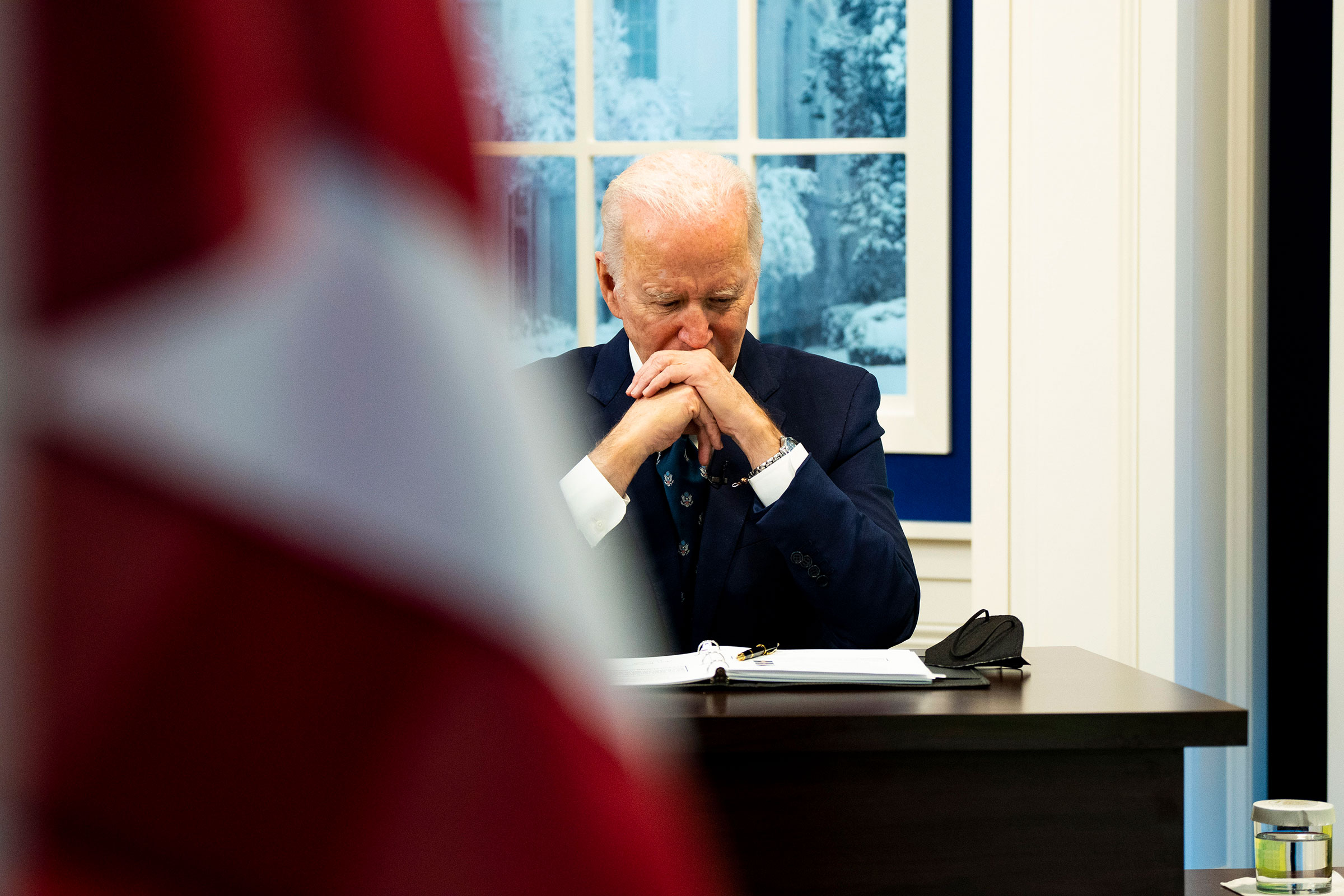

The international tax reforms included in the Act. Build Back Better Act Budget Reconciliation Bill Summary Updated January 20 Negotiations have stalled between the White House and US. After months of negotiations on November 19 the US.

House of Representatives passed the Build Back Better Act HR. Some of the new provisions would build on actions Congress previously took in the American Rescue Plan Act enacted earlier this year. The Build Back Better framework is fully paid for.

Reduces carbon pollution by 40 percent by 2030. The redesign includes a maximum-out-of-pocket MOOP of 2000 and elimination of the coverage gap. The 175 trillion legislation includes major investments in health care housing education jobs climate and other social programs.

Combined with savings from repealing the Trump Administrations rebate rule the plan is fully. The Build Back Better Act will create millions of good-paying jobs enable more Americans to join and remain in the labor force spur long-term growth reduce price pressures and set the United. The bill was passed 220213 by the House of Representatives on November 19 2021.

5376 summary on November 19 2021. The Build Back Better Act includes investments to ensure at least 40 of the benefits of climate and infrastructure initiatives go to overburdened and underserved communities. The bill includes about 17 trillion in gross revenue raisers composed of about 470 billion in corporate tax increases 530 billion in individual tax increases 148 billion net from additional irs tax enforcement 340 billion from the drug pricing provisions and about 177 billion in net revenue from ways means items scored by the joint.

How The Biden Administration Lost Its Way Time

Biden Preparing Executive Action On Climate After Manchin Sinks Legislative Approach Cnn Politics

The Build Back Better Framework The White House

From Dazzled To Doubtful New U S Climate Deal Draws Range Of Reactions Science Aaas

Biden S Build Back Better Agenda Stalls In The Senate Npr

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/71054624/1240581635.7.jpg)

Democrats Are Taking What They Can Get From Joe Manchin On Build Back Better Vox

The Build Back Better Framework The White House

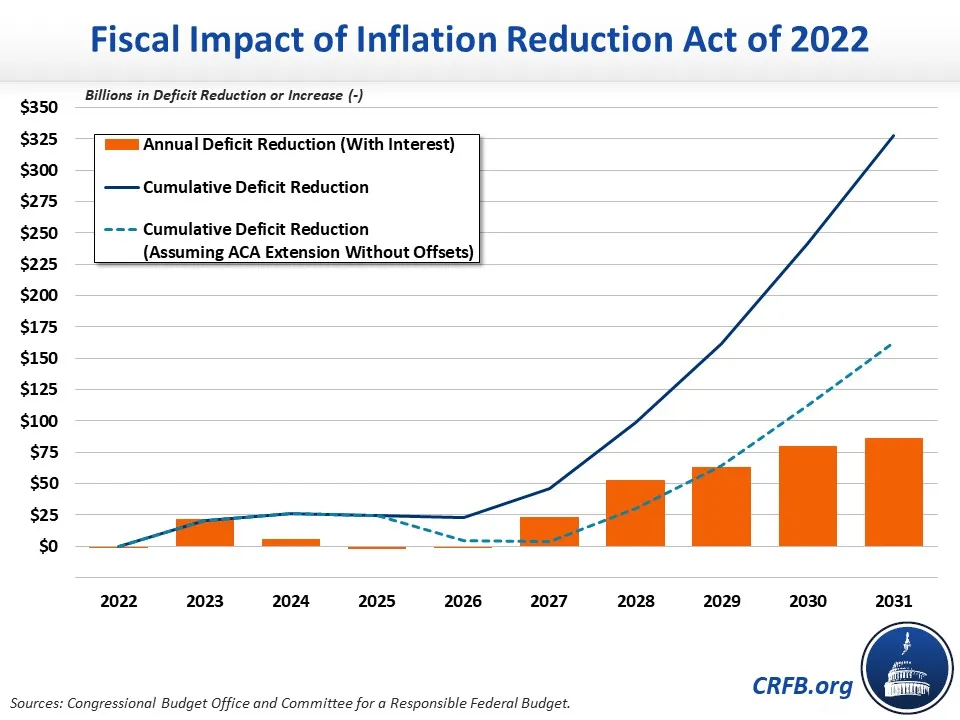

What S In The Inflation Reduction Act Committee For A Responsible Federal Budget

The Build Back Better Framework The White House

Whatever This Is It Won T Be Build Back Better

The Infrastructure Plan What S In And What S Out The New York Times

The Build Back Better Framework The White House

Senate Democrats Reckless Gamble On Build Back Better The Atlantic

The Build Back Better Framework The White House

Key To Biden S Climate Agenda Like To Be Cut Because Of Manchin The New York Times

Biden S Build Back Better Wants To Save America S Child Care Business Bloomberg

How The Biden Administration Lost Its Way Time

Democrats Try To Build Back A Bit Better The Atlantic

Senate Democrats Produce A Far Reaching Climate Bill But The Price Of Compromise With Joe Manchin Is Years More Drilling For Oil And Gas Inside Climate News