georgia ad valorem tax 2021

Owners of vehicles that fit this category. The ad valorem tax or property tax is the primary source of revenue for local governments in GeorgiaAd valorem means according to value2021 Property Tax bills will be mailed out by.

Gwinnett County Waives Convenience Fees For Property Tax Payments

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia.

. Here are the instructions how to enable JavaScript in your web browser. Jul 26 2012 Messages. General Information on Georgia Ad Valorem Taxes Tax Year Statewide Uniform The Georgia real estate tax year runs on a calendar year basis ie.

Mar 04 2022 For example Georgia in 2013 changed the way vehicles are charged tax replacing a general sales tax and annual ad valorem tax with a title tax. Starting January 1st of 2018 taxes now only include the sum of lease payments not the entire value of the vehicle as it was set up before. Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax.

Brookdale hospital medical center. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

This tax is based on the value of the vehicle. Section 179 allows you to deduct a 100 of the cost of qualifying. Georgia ad valorem tax motorcycle Wednesday March 9 2022 Edit.

Because of these changes the Title. Flux core welder 120v. Georgia income taxes for the taxable year of death.

Limits on Section 179 deductions. Title Ad Valorem Tax Calculator Vehicles purchased on or after March 1 2013 and titled in Georgia will be exempt from sales and use tax and the annual ad valorem tax. For full functionality of this site it is necessary to enable JavaScript.

90 plus applicable ad valorem taxCost to renew annually. Since march 1 2013 georgia has a new title ad valorem tax tavt that applies to all. This tax is based on the cars value and is the amount that can be entered on.

From January 1st through December. Georgia ad valorem tax calculator 2021. Can a lawyer turn against their client.

A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to expand. Starting January 1st of 2018 taxes now only include the sum of lease payments not the entire value of the vehicle as it was set up before. As of 2018 residents in most Georgia counties pay a one.

Georgia ad valorem tax calculator 2021. This change hit car leasing. Georgia HB1101 2021-2022 A BILL to be entitled an Act to amend an Act providing a homestead exemption from Early County school district ad valorem taxes for educational.

Total Sales Tax - 7 2021 Inventory Tax Exemptions Freeport Freeport is the general term used for the exemption of ad valorem tax on inventories as defined by Georgia. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage. Semi precious stone rings uk.

5500 plus applicable ad valorem taxOf the Initial 90 fees collected for the issuance of these tags the. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

Property Taxes In Statesboro Set To Creep Up Almost 5 The Georgia Virtue

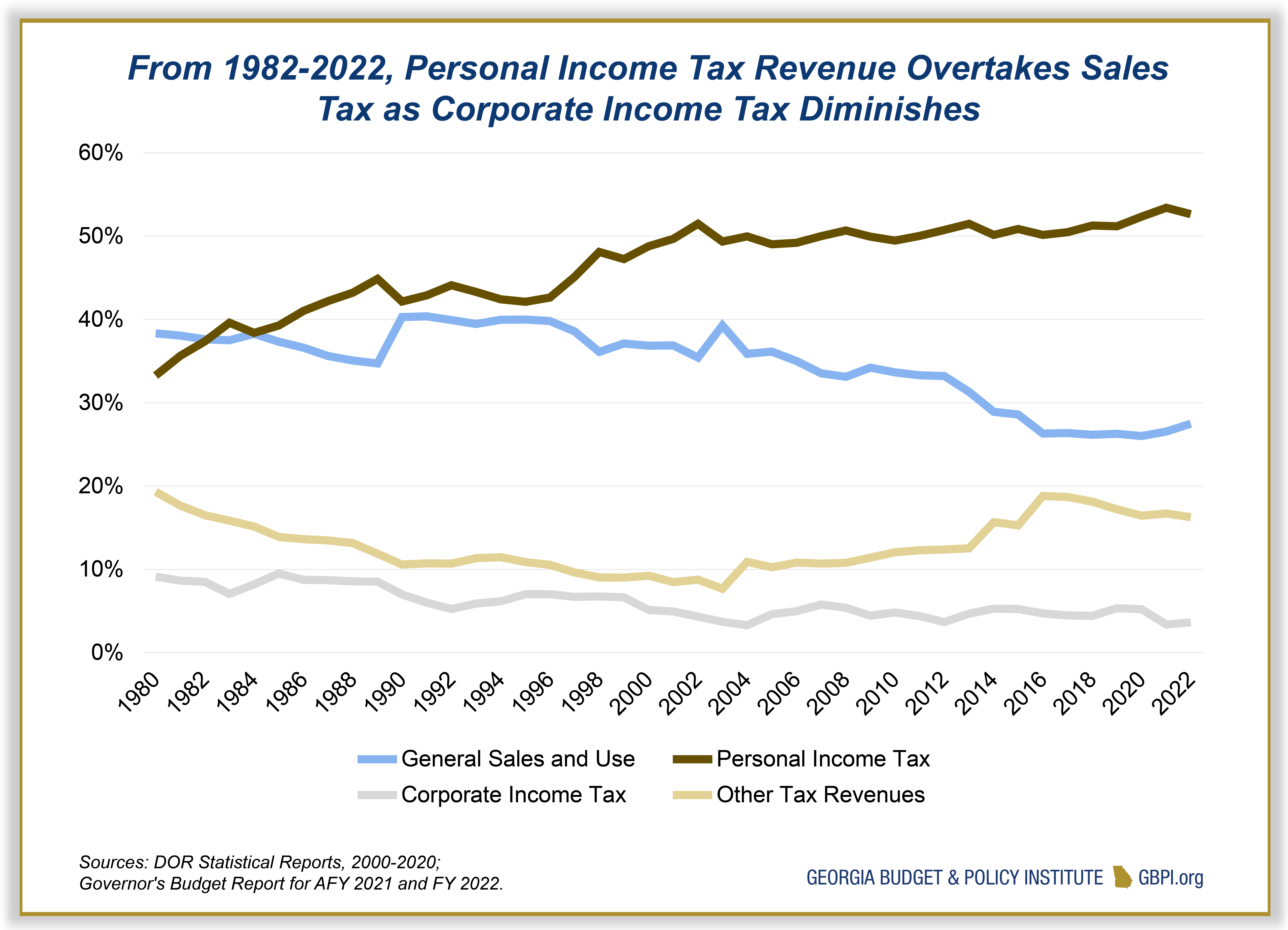

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Official Website Of The City Of Lagrange

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

What Is Homestead Exemption How To Reduce Property Taxes Georgia Taxes 2021 Property Taxes Youtube

2021 Property Tax Bills Sent Out Cobb County Georgia

Georgia Property Tax Increases Among Highest In Nation 11alive Com

Catoosa County Georgia Residents Suggest Cuts To Avoid Property Tax Increase Chattanooga Times Free Press

Georgia Department Of Revenue Local Government Services Motor Vehicle Divisions Ppt Download

State Property Taxes Reliance On Property Taxes By State

Dawson County Tax Commissioner Nicole Stewart On Twitter Support Our Troops Tag Initial Purchase Is 80 00 25 Manufacturing Fee 35 Special License Plate Fee 20 Registration Fee Ad Valorem Tax If

Specialty And Disabled Tags Newton County Tax Commissioner

Tax Rates Gordon County Government

Tax Rates Gordon County Government

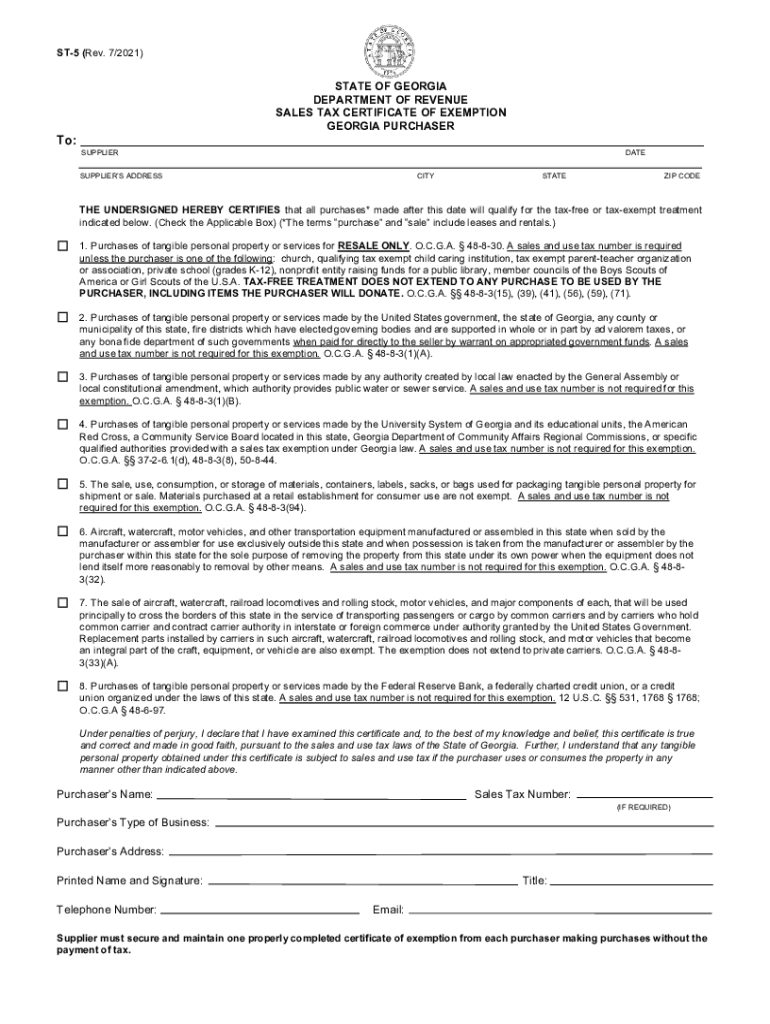

2021 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com